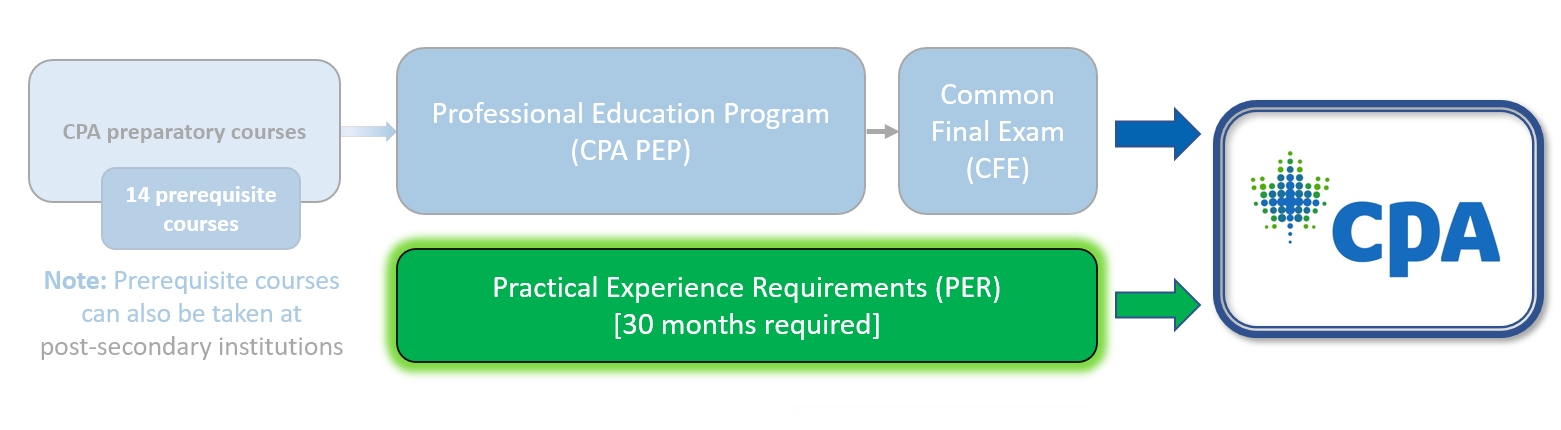

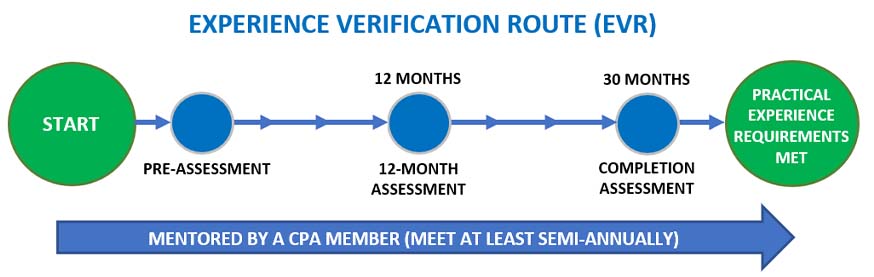

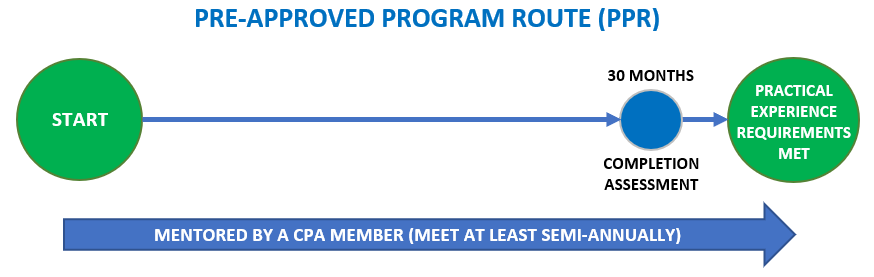

There are two routes you can take to complete the practical experience requirements:

The Experience Verification Route provides flexibility in your role but requires more reporting. You choose the employer, provided the role allows you to demonstrate competencies and gain relevant practical experience. Future CPAs complete detailed experience reports in PERT that are reviewed by the profession at key milestones. Supervisors verify and attest to the accuracy of experience reports..jpg)

Pre-approved programs are training positions that have been approved by the CPA profession in advance and are designed for you to meet the practical experience requirements within 30 months. As a result, less documentation in PERT is required from future CPAs taking this path. Review by the profession occurs when you complete the program. Qualifying experience for the audit and review (where applicable) streams of public accounting can be gained only through the pre-approved programs. .jpg)

Regardless of the experience route taken, a minimum total of 30 months of practical experience is required, consisting of relevant paid employment that is progressively challenging for the future CPA to develop as a professional accountant. The period of practical experience cannot begin until you have a CPA mentor.

Reporting experience prior to your CPA PEP admission application being approved

Prior experience of a minimum of 3 months to a maximum of 12 months may be recognized as qualifying practical experience towards the total 30 month minimum that is required. To ensure experience is relevant, all experience must be gained in positions that ended within the last 7 years. In assessing prior experience, final approval is at the discretion of the provincial body.

If you are unsure whether your past experience, current role, or a prospective one is relevant for the CPA Practical Experience Requirements, you can use the Practical Experience Self-Assessment Tool to approximate whether or not it will be usable.

See the website links and provincial contact information below for more information.

Your experience report details the duration of the experience, the type of experience being gained and your self-assessment of this experience. Your gained experience is self-assessed at least twice a year and discussed with your CPA mentor.

Practical Experience Competencies

Regardless of the route you choose, you are required to complete a minimum of 30 months of relevant practical experience and develop breadth and depth of technical competencies and development of enabling competencies as per the CPA Competency Map .

| Technical Competencies | Enabling Competencies |

| 1. Financial Reporting | 1. Acting Ethically and Demonstrating Professional Values |

| 2. Management Accounting | 2. Solving Problems and Adding Value |

| 3. Strategy and Governance | 3. Communicating |

| 4. Taxation | 4. Managing Self |

| 5. Finance | 5. Collaborating and Leading |

| 6. Audit and Assurance |

See the website links and provincial contact information below for more information.

The period of practical experience cannot begin until you have a CPA mentor. The mentor must be a CPA in good standing, or a designated member in good standing with a recognized professional accounting body. The mentors must register with the provincial CPA body before commencing their mentorship of the candidate.

You must meet and discuss your progress with your CPA mentor, at least semi-annually. The mentor provides guidance on your competency development as a CPA candidate and models and facilitates the development of the profession’s values, ethics, and attitudes.

Finding a Mentor

The process by which candidates are matched with a mentor depends on their chosen route:

- CPA Pre-approved Program:

Candidates are matched with a CPA mentor by the organization offering the program. - Experience Verification:

The Candidates seek out their own CPA mentor to find a successful fit. There are supportive networking resources available to help match candidates with CPA mentors if they are unsuccessful in finding a mentor.

See the website links and provincial contact information below for more information.

Your supervisor is the person to whom you report. Your supervisor is responsible for either assigning you the required experience in a pre-approved program, or within the experience verification route, verifying that your experience is factually accurate in your experience report.

Your supervisor does not need to be a designated accountant. Supervisors who meet the mentor criteria can perform the roles of supervisor and mentor for the candidate.

See the website links and provincial contact information below for more information.

At key milestones, the experience report must be reviewed by the profession. Experience that satisfies the practical experience requirements may be recognized, whether it is gained domestically or internationally. (There may be exceptions for CPA students/candidates developing an area of depth in a standards-based competency area, and for chargeable hour requirements for CPA students/candidates pursuing public accounting.)

See the website links and provincial contact information below for more information.

.jpg?ext=.jpg)